Money has shaped civilizations for thousands of years. From barter trade to coins, paper money, and now digital currencies, money has evolved to make transactions smoother and more efficient. But what is money? How did we reach a point where numbers on a screen can buy real-world products?

In this blog, we’ll explore how money evolved, who controls its value, and where the future of currency is heading.

1.What is Money, and What is Currency?

Money is anything that people accept as payment for goods and services. It can take many forms—gold, paper, digital numbers, or even a promise of value. Currency, on the other hand, is a physical form of money, such as coins and banknotes.

But who decides the value of money? In ancient times, its value depended on the material used (gold, silver, etc.). Today, it is controlled by central banks and influenced by factors like demand, supply, inflation, and economic policies.

Before organized money systems existed, trade was simple yet inefficient. Let’s step back in time to where it all began—the barter system.

2.The Barter System: A World Without Money

Imagine you are a farmer with wheat, and you need milk. You visit a herder and exchange wheat for milk. Simple, right?

This system worked in small communities, but it had major problems:

Why Did the Barter System Fail?

❌ Double Coincidence of Wants – You need something the other person has, and they must want what you offer.

❌ No Standard Measure of Value – How much wheat is equal to one cow?

❌ Difficult to Store Wealth – You can’t save perishable items like food for long.

To solve these issues, people started using objects with universal value—this led to the birth of money.

3.The Birth of Money: Coins and Precious Metals

As civilizations grew, people started using commodity money—objects that had value beyond just trade. Some early examples include:

- Cowrie shells (China, Africa)

- Salt (Rome, Africa – “salary” comes from the Latin sal, meaning salt)

- Metal pieces (Lydia, Mesopotamia)

However, metal became the most reliable choice, especially gold and silver, because they were:

✔ Durable

✔ Rare and valuable

✔ Easy to transport

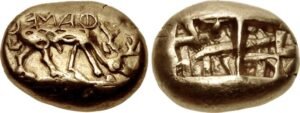

Which Civilization First Used Coins?

The first metal coins were minted in Lydia (modern Turkey) around 600 BCE. King Alyattes of Lydia introduced electrum coins, a mix of gold and silver, marked with the king’s seal.

Other ancient civilizations also minted coins:

- Persians (500 BCE) – Darius the Great introduced the gold Daric, one of the most stable currencies.

- Greeks (400 BCE) – Used silver drachmas for international trade.

- Romans (300 BCE – 400 CE) – The denarius became the main currency of the empire.

Coins solved many problems of barter but were still heavy to carry. So, societies looked for a more convenient alternative—paper money.

4.The Rise of Paper Money: Convenience Over Coins

Carrying large amounts of metal coins was risky and inconvenient. China was the first to introduce paper money.

How Did Paper Money Start?

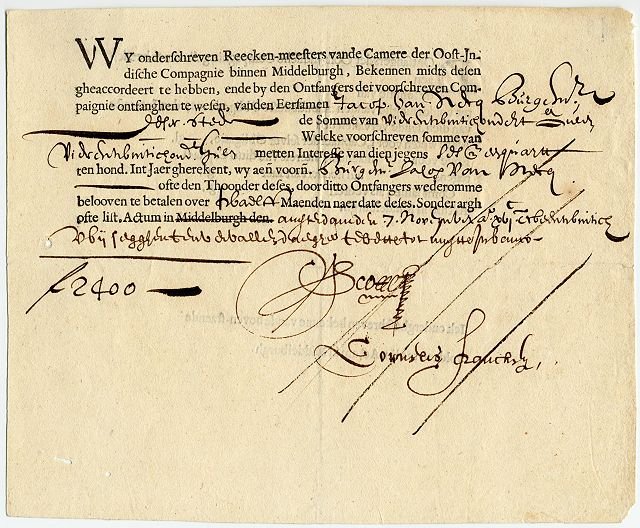

During the Tang Dynasty (7th century CE), Chinese merchants deposited gold and silver with trusted individuals (money handlers) and received written receipts. These receipts became exchangeable for goods and services, acting as money.

By the 11th century (Song Dynasty), the Chinese government officially printed banknotes, called Jiaozi. This was the first government-issued paper currency in history.

Paper Money in Europe

- In the 13th century, Marco Polo brought the idea of paper money from China to Europe.

- By the 17th century, European banks issued banknotes backed by gold reserves.

- The Bank of England (1694) started issuing promissory notes, which later became official banknotes.

The Gold Standard: How Paper Money Gained Trust

For a long time, banknotes were exchangeable for gold. This system, called the gold standard, ensured paper money had real value.

For example, if you had a £5 note in 1800, you could go to a bank and exchange it for an exact amount of gold.

However, in the 20th century, most countries abandoned the gold standard and let central banks control the money supply.

5.The Evolution of Banking: From Gold Storage to Global Finance

Banks originally started as gold storage services. People deposited gold, and banks issued paper receipts (promissory notes) in return.

Over time, banks noticed something: most people didn’t withdraw all their gold at once. This allowed them to:

✔ Lend money to others and charge interest.

✔ Create a system where loans drive economic growth.

How Did Central Banks Arise?

As private banks gained power, governments feared instability. So, they created central banks to:

- Control money supply

- Stabilize the economy

- Act as lenders during financial crises

Some of the world’s most powerful central banks today include:

- Federal Reserve (USA, 1913)

- European Central Bank (EU, 1998)

- Reserve Bank of India (India, 1935)

With banking systems in place, the next evolution came—digital money.

6.The Digital Revolution: From Credit Cards to Cryptocurrencies

The 20th and 21st centuries saw a massive shift towards electronic transactions.

✔ Credit Cards (1950s): Let people buy now and pay later.

✔ Online Banking (1990s): Allowed instant digital transactions.

✔ Cryptocurrency (2009-Present): Bitcoin introduced decentralized money.

What is Cryptocurrency?

Bitcoin was created in 2009 as a digital currency with no government control. Unlike traditional money, it:

✔ Operates on blockchain technology.

✔ Has a limited supply (only 21 million BTC will ever exist).

✔ Can be transferred anywhere without banks.

But it has challenges, like price volatility and lack of regulation.

7.The Future of Money: What’s Next?

Money is evolving towards a fully digital and cashless future. Some possible trends include:

- Central Bank Digital Currencies (CBDCs): Governments may issue their own digital currencies, replacing cash.

- AI in Finance: Smart contracts could make banking autonomous.

- A Cashless World: Countries like Sweden and China are already moving towards it.

However, a fully digital world could mean:

❌ Privacy concerns

❌ Cybersecurity risks

❌ Over-reliance on technology

The challenge will be balancing innovation with security.

Conclusion: A Journey Through Time

From barter to Bitcoin, money has constantly evolved to solve society’s trade problems. Each system had its advantages and disadvantages, but the core idea remained the same—facilitating trade and trust.

As we enter a digital era, one question remains: Will physical money disappear entirely? Only time will tell.

Would you prefer cash, card, or crypto for your next purchase? The future of money is being shaped right now!